Planned Giving

You can leave a legacy of support by including the Holocaust Remembrance Association in your estate plan.

Thank you so much for considering Holocaust Remembrance Association in your legacy giving. We rely solely on voluntary gifts from those who share our vision to see the world inspired to stand in solidarity against persecution, prejudice, and indifference.

There are many ways to make a gift to the Holocaust Remembrance Association, As you consider your options for cash gifts, estate gifts, or any other potential long-term strategies, we encourage you to speak with your financial adviser about the ways in which you might proceed.

Planned giving often requires complex transactions with significant legal and tax implications, and we suggest that you consult experts in tandem with the Holocaust Remembrance Association in order to design a giving strategy that best meets your goals and objectives.

There are a number of planned giving options that enable your estate to benefit you, your heirs, and the Holocaust Remembrance Association. Advantages for you and your estate can include:

- Reduce estate taxes

- Provide the Holocaust Remembrance Association an income stream for the life of donor

- Enable you to make a much larger gift

- Receive an income tax deduction

- Reduce or avoid capital gains taxes

Some of the planned giving options available to you include:

Bequests and Trusts

A bequest is a transfer of cash or marketable securities through a will or a living or revocable trust. Your bequest can be a gift of a specific dollar amount, a specific piece of property, a percentage of an estate, or all or part of the residue of an estate. You can also name the Holocaust Remembrance Association as a contingent beneficiary if someone named in your will is no longer living at the time of your passing.

Retirement Plans

You can name the Holocaust Remembrance Association as the beneficiary of your 401(k), IRA, Keogh, or other retirement plan. Your heirs will also avoid a twofold taxation on retirement plan assets.

Life Insurance

Naming the Holocaust Remembrance Associationas a beneficiary of your life insurance policy is an excellent way to make a major gift. If you are carrying more life insurance coverage than your obligations require, consider naming the Holocaust Remembrance Association the irrevocable owner and beneficiary of your surplus policy. The gift of a fully paid policy produces a charitable deduction in the amount of the policy’s cash surrender value with no additional cost to you. You may also designate the Holocaust Remembrance Association as a revocable beneficiary, or transfer ownership of the policy to the Holocaust Remembrance Association. With a transfer, you can immediately deduct the current value of the policy from your income taxes, and if you are still paying premiums, you can deduct the cost of those premiums each year.

Bank Accounts

You can name the Holocaust Remembrance Association as the beneficiary on your bank account, U.S. savings bonds, or U.S. Treasury securities. Your bank can set up a “Totten Trust,” which is an informal arrangement that keeps you in control of your assets during your lifetime. Your accounts do not enter probate and your assets automatically pass to the Holocaust Remembrance Association.

Charitable Trusts

Charitable gift annuities, charitable remainder trusts, charitable lead trusts, and other vehicles for planned giving can reduce your potential tax liability and allow you and your heirs more flexibility in your giving.

Donor-Advised Funds

A donor-advised fund is an investment account established by you exclusively for charitable gifts. Contributions to the fund are tax-deductible, and the assets in the donor-advised fund grow tax-free. You may make grant recommendations to a variety of local or national nonprofit organizations, and your intent for charitable giving is respected during and after your lifetime.

If you have questions about setting up a planned gift, or if you have included the Holocaust Remembrance Association in your estate planning, please contact Mitch Jerome at MitchJ@hra18.org or at 888-546-8111, extension 3.

More ways to give

Become a Member of the Holocaust Remembrance Association

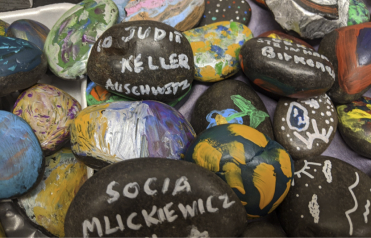

Support the Holocaust Garden of Hope